ICW | Mondaq

Global In-House Counsel Report 2024

Unique Insights into the Global In-House Profession

Think before you print

Sponsored by

INTRODUCTION

In-House Counsel Worldwide (ICW) and Mondaq are pleased to present the results of our inaugural 2024 Global In-House Counsel Survey.

This report provides insight into the current state and future trends of the global in-house counsel profession. With global in-house counsel respondents from over 60 countries and feedback across all in-house job levels, the report provides unique insights into areas including investment priorities, in-house activities, outsourcing, as well as several important people-focused topics.

We’d like to thank the global in-house community for their participation in our new survey, as well as our advisory board participants for their sage counsel. Thank you also to our survey and report sponsor, Alexa Translations, for enabling us to further amplify the survey findings and analysis.

It’s our hope that you’ll find this report useful in helping you to make informed decisions about your and your global legal department’s priorities now and in the future.

In-House Counsel Worldwide (ICW) is a global network of member-associations that represent the legal professionals who work as corporate counsel and/or in-house lawyers within companies or organisations.

The primary mandate of ICW is to unite this community globally to share best practices, standardize competencies, promote standards and ethics, and collaborate to advance this sector of the legal profession for both the lawyers and their organisations.

Mondaq is a leading global provider of AI-enabled content marketing, data and analytics solutions for professional services firms. Mondaq powers firms’ marketing & business development success through client, prospect and market insights based on a global audience of senior-level decision makers.

Mondaq delivers answers to legal, tax and compliance questions to an audience of over 20 million readers worldwide.

Sponsored by

METHODOLOGY

In March 2024, ICW and Mondaq launched a new, annual Global In-House Counsel Survey.

The survey’s aim is to provide unique insight into global legal departments and the global in-house counsel profession, by being one of the most comprehensive and representative surveys into the state of global in-house legal departments.

Nearly 400 respondents from over 60 countries, across different job levels, completed the 41-question online survey between March and May 2024, with questions covering a number of areas that are important to global in-house legal departments and in-house counsel, including investment priorities, in-house activity, outsourcing, technology and innovation and people-focussed questions (culture, challenges, wellbeing, equality, diversity & inclusion).

This was followed by a voluntary self-identification section, which over 50% of respondents went on to complete.

To provide rigorous oversight and authority, the survey was designed in partnership with our survey Advisory Board, which includes eminent global in-house counsel.

Advisory Board

Steven Rotstein

President

ICW

Philippe Coen

Vice President

ICW

Daniel Choo

Co-President

Singapore Corporate Counsel Association

Alison Lee

Chief Executive Officer

Corporate Counsel Association of South Africa

Location

A

Role

Organization Size by Employees

PARTICIPANT PROFILE

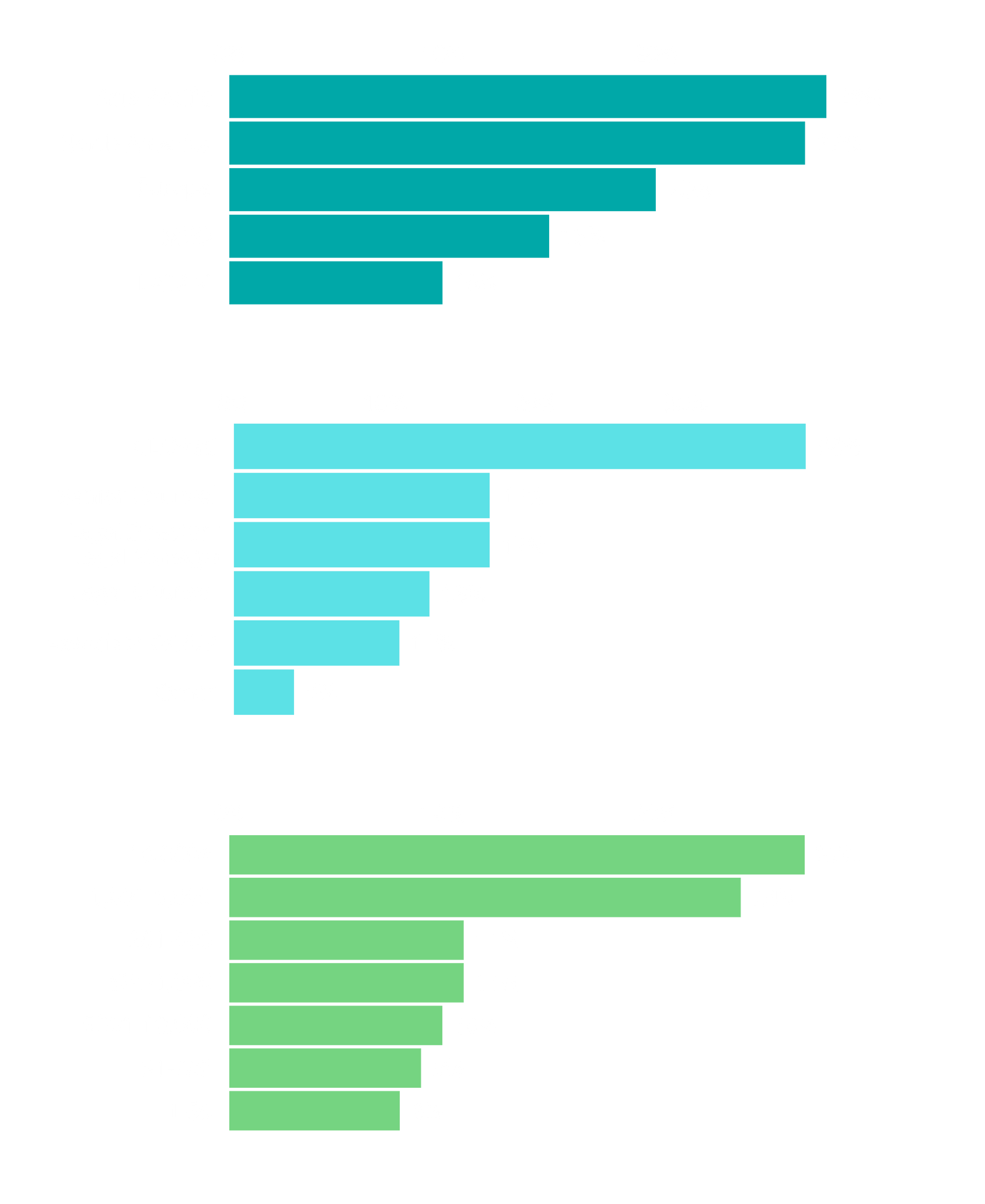

The survey responses have provided the representative view we were seeking, with 38% of participants providing a view from the top (CLOs/GCs) and excellent representation throughout global legal departments, with a significant number of Senior Counsel (17%), Counsel (13%) and Director of Legal Services/Legal Manager (17%).

The survey saw excellent response levels from public companies (36%) and private companies (53%), representing all the key industry sectors and organization sizes, as well as from government organizations (5%) and not-for profits (4%).

The survey responses are also geographically distributed, from North America (27%) to Latin America (10%), Europe (20%), Asia Pacific (28%) and the Middle East & Africa (15%), to provide a regionally balanced lens into the global in-house profession. More survey respondent specifics are to be found in the Participant Profile charts to the right.

Sponsored by

EXECUTIVE SUMMARY

As the effects of troubling regional conflicts and political turmoil reverberate through the world’s economies, In-House Counsel Worldwide & Mondaq’s 2024 In-House Counsel Report seeks to reveal the challenges, issues and priorities facing global in-house legal teams worldwide.

The extensive questionnaire and survey participation allow us to provide unique insight into the current state of global legal departments and their direction of travel for the coming year – as well as insights into the global in-house professional today.

In the current climate, in-house counsel face numerous challenges – which can be seen as contributors to dramatically rising levels of workload and a corresponding increase in work-related stress and anxiety levels.

~400

Respondents

> 60

Countries

In response, almost four out of ten legal departments expect to see growth in global in-house counsel budgets over the coming year. Demand for in-house services looks set to rise significantly – with investment in additional people and technology being the main focus of increased spend.

Within this increasing demand for in-house services, there is a strong emphasis on supporting business growth, with risk management and compliance responsibilities also prominent. In fact, in-house counsel are carrying a significant breadth of accountabilities beyond their legal remit. These include compliance, ethics, company secretarial, investigations and government relations responsibilities.

54%

of respondents seeing an increase in

work-related stress and anxiety levels in

the last year

The increasing levels of accountabilities raise the prospect of a potential employee wellbeing and mental health crisis looming in the coming years. There is limited evidence of companies recognizing the emerging need to prioritize employee support and wellbeing within legal departments.

The changing landscape and the attendant demand for in-house legal services is also driving increased spend on technology. Globally, around two-thirds of companies expect to invest more in technology. But almost 8 in 10 view cost as the biggest barrier to technology adoption.

Increasing levels of in-house demand, workload and accountabilities raise the prospect of a potential employee wellbeing and mental health crisis

AI / Generative AI is a key focus area for innovation for a substantial 44% of companies globally. We also expect to see investment growth in supportive technologies around data privacy and security management – plus the digitalization and automation of contracts, documents and processes.

Post-pandemic, hybrid working models now seem well-established with over 70% of counsel able to access a mix of office and home or remote working arrangements. However, there are stark differences regionally, with 81% of counsel in Europe and 74% in North America offered hybrid, compared to just 32% in the Middle East and Africa.

But concerns around employee engagement, remote use of sensitive data and confidence in remote-working technology may be adding to rising stress levels – and spotlight where employee support may need to be focused.

legal departments expect to see growth in global

in-house counsel budgets over the coming year

4 OUT OF 10

While additional investment in people and technology will meet much of the rising demand for internal services, companies also expect to increase their spending on outside counsel. From the buy-side, when selecting outside counsel there is almost universal consensus that practical advice, legal expertise and understanding of the buyer’s business are the most important factors – far more so than the existence of senior-level relationships.

It is evident that the best in-house lawyers today require so much more than legal skills. Our survey shows that understanding of the business stands out as the primary requirement, with flexibility and the ability to give practical advice much to the fore – alongside legal expertise.

It’s likely that the broadening of accountabilities and demand for business-aware skills indicate a rise in reach and influence that in-house counsel can have within the organization.

The best in-house lawyers today require so much more than legal skills

Sponsored by

Budgets & Investment Priorities

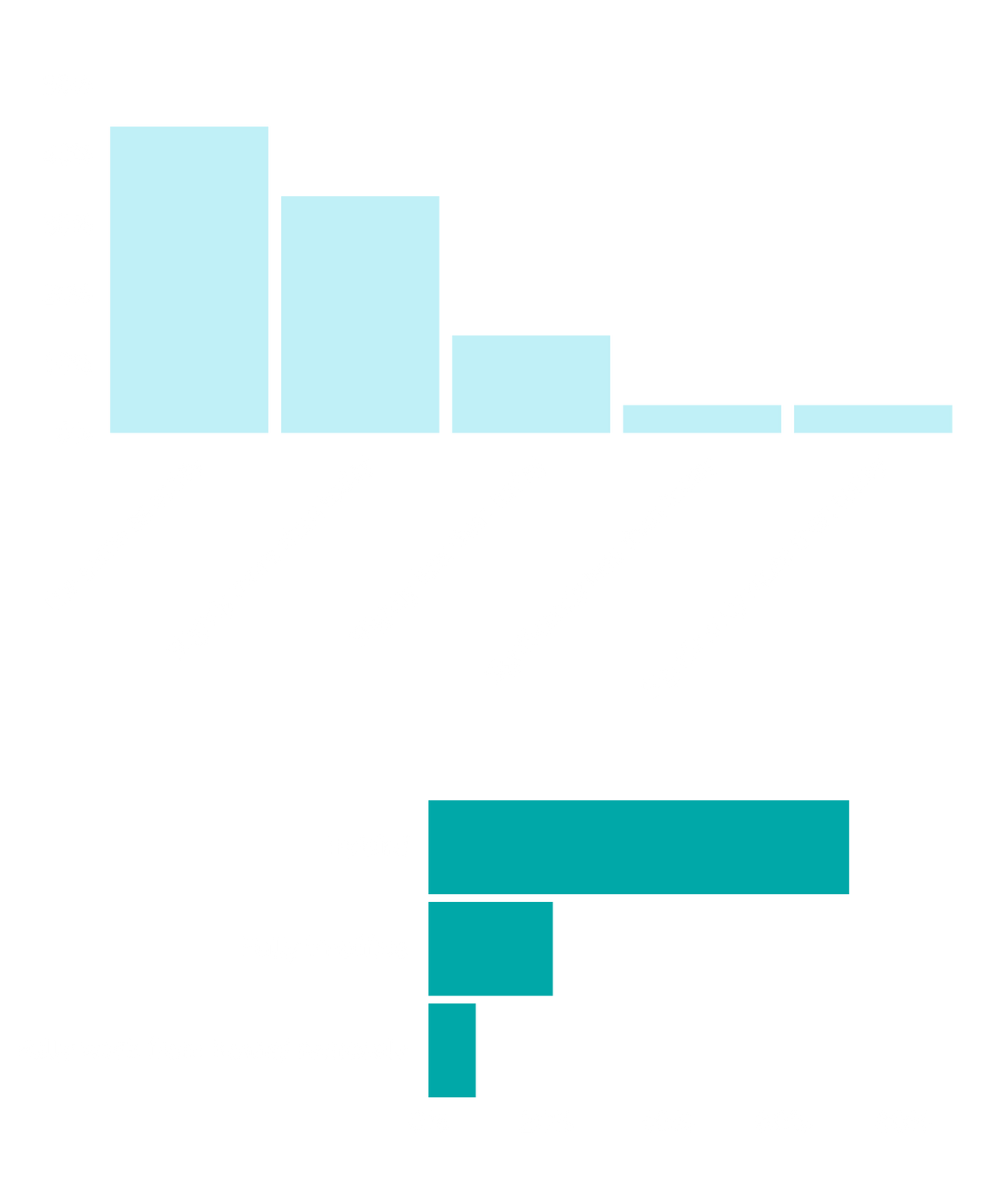

Almost four in ten global legal departments (38%) expect to see growth in global in-house counsel budgets over the coming year. This is significantly more than the 18% that expect budgets to decline.

The most pronounced growth is likely to be in the privately held companies. Here, 42% expect budget growth compared to just 15% expecting decline. But among publicly held companies, the difference narrows to just 28% that expect budget growth against 22% expecting decline.

But there is a marked difference across regions, with budget growth expectations being highest in Middle East & Africa and Latin America. Almost two-thirds (65%) of MEA and 47% of LatAm headquartered companies expect budgets to rise. In Asia Pacific the percentage drops to 34% both Europe and North America, that proportion drops to just under

one-third (32%).

Technology is the clear leader among investment priorities. Globally around two-thirds of public and private companies expect to increase technology spending. The regional picture is broadly consistent, with 55-60% of companies expecting to spend more on technology. Across most regions a small proportion of legal departments – fewer than 5% – expect to reduce their technology investment. North America is the exception, where 13% of companies expect to spend less on legal department technology.

Expected Size of The Total Global In-House Legal Department Budget Over The Next Year:

Technology is the clear leader among investment priorities. Two-thirds of global legal departments expect to increase technology spending

Staffing is the next main beneficiary of additional investment, with 39% of companies globally expecting budget growth for in-house staff. In Middle East & Africa region the figure rises significantly to 67%. Across the globe this increase is likely driven by both salary inflation as well as via new recruitment, as 34% of organizations globally expect in-house headcount growth.

Global legal departments also expect to increase their spending on outside counsel, albeit at a more modest rate than on technology and staffing. The proportion of private companies expecting to do so (35%) is significantly higher than those expecting to reduce outside counsel spending (23%). The figures broadly balance for public companies, indicating tighter management of spend on outside counsel in listed companies.

Where outside counsel budget growth is expected, the regional picture is mixed. 35-37% of companies across North America, Asia-Pacific and Middle East & Africa expect to spend more, 31% of Latin American companies but only 24% of European companies. Europe is also the only region where there is a higher proportion (28%) of companies expecting to reduce their spend on external counsel.

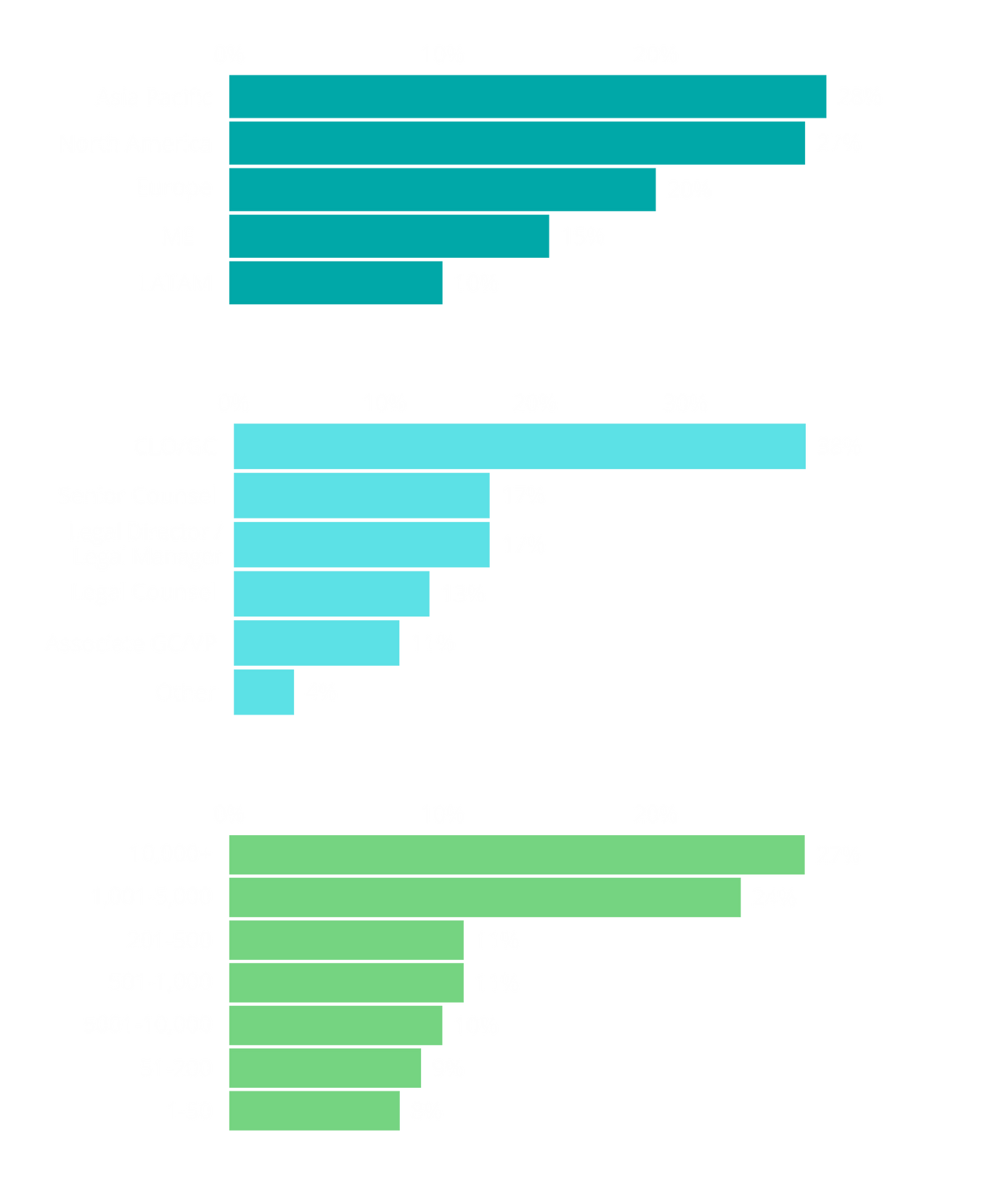

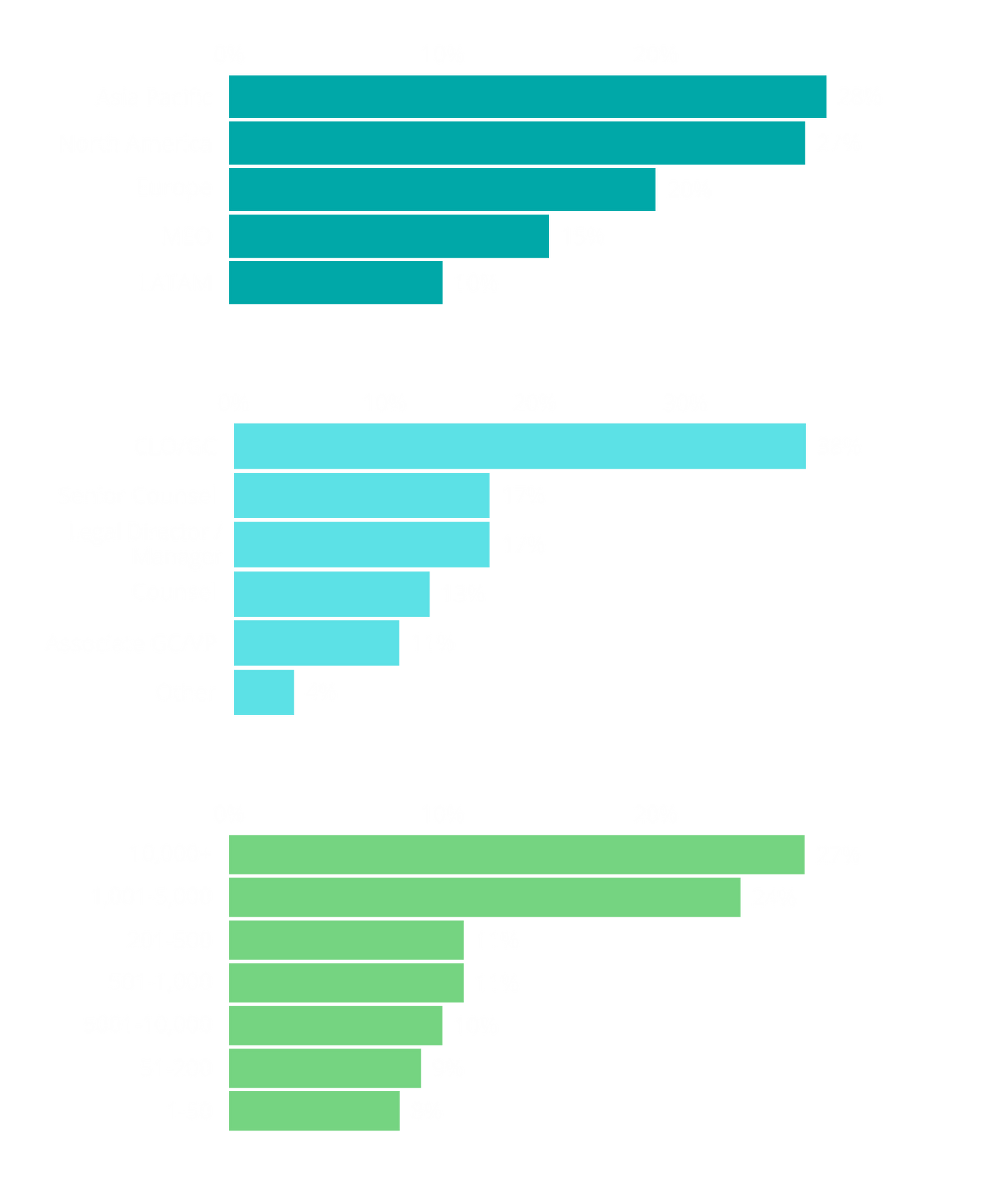

Expected Increase in In-House Demand

Additional investment in both technology and staff may be as a consequence of increased pressure on in-house demand, with large rises expected in global legal department activity across a range of areas.

Large majorities of global in-house departments expect to see increasing focus in areas such as Risk & Compliance (72%), Data Privacy (62%) and Contract Management (57%). Departments can also expect substantial increases in activities around Business Strategy & Advice (41%), Dispute Resolution (34%) and Labour & Employment (29%).

So, while demand for in-house services looks set to rise significantly, investment in additional people and technology is expected to scale up to meet that demand.

Sponsored by

OUTSOURCING

Outsourcing

Reliance on outside counsel will remain strong despite the anticipated rise in legal department headcount. This may in part be a response to heightened levels of accountability and demand on in-house resources. In the coming year, almost one-third (32%) of companies globally expect to spend more on outsourcing work to external counsel. But this will be offset by 23% reducing their outsourcing spend. So, the overall increase in spending is likely to be relatively modest.

Reliance on outside counsel will remain strong despite the anticipated rise in

legal department headcount

All of the regions, bar Europe, are expecting a modest increase in the value of work outsourced to outside counsel. North America and Asia Pacific are expecting the biggest increase, while Europe is one of the only regions where the number of organizations expecting to spend less on outside counsel, outweigh those planning to spend more.

Important Factors When Selecting Outside Counsel

As to the crucial factors for buyers when selecting outside counsel, there is a high correlation of the top five buy-side drivers both across regions and between public and private companies. In fact, there’s almost universal consensus that practical advice (99%), legal expertise (98%) and understanding of the buyer’s business (97%) are the most important factors. Over 8 in 10 companies also rate each of these as ‘very important’. Client service (94%) and value for money (93%) are the next most important. It’s notable that North American companies place a distinctly higher priority on client service, with three-quarters rating it very important, against the global figure of 67%. Only 22% of companies say existing senior-level relationships are very important. This may indicate to firms that buyers may no longer set so much store in long-standing relationships.

When Outsourcing

89%

66%

Outsource within

their Home Country

Outsource outside of

their Home Country

Top 3 Buy-Side Factors When Selecting Outside Counsel

99%

practical advice

98%

legal expertise

97%

understanding of the buyer’s business

Turning to the types of work most likely to be outsourced, we see highest demand for outside counsel in areas new to the organization (73% of respondents) – and where it seeks expert opinion or assurance on specific activities or transactions (70%). Over half of respondents (55%) would also seek outside counsel advice both in emerging areas of law, and for activities where there’s a lack of internal capacity. Interestingly, public companies’ global legal departments are 20% more likely than their private counterparts to outsource advice on emerging areas of law.

These four main areas are common across both private and public companies, and across all regions. There is also a clear distance between the top four and other criteria for outsourced work.

Other Outsourcing

Broadly one-fifth (22%) of all in-house legal teams use Alternative Legal Service Providers (ALSPs) for services that law firms would traditionally offer. This rises to 24% for large organizations of over 5,000 employees. Public companies are more likely than private companies to use ALSPs. The global figure varies regionally by a few percentage-points and is highest in Asia-Pacific, where a quarter of companies use ALSPs.

E-discovery is outsourced by just under one in ten legal departments in public companies, rising to over 17% in private companies. It’s most prevalent in North America, with one in five companies outsourcing, and least likely in Asia-Pacific (8%).

By contrast, translation services are more likely to be used by companies in Asia-Pacific and Middle East & Africa regions than in Europe and North America.

The most popular destinations for outsourcing legal department work are India, Philippines, Singapore, Netherlands, Canada and South Africa.

Percentage of Legal Departments Using

ALSPs

E-discovery

22%

14%

16%

Translation services

Sponsored by

INNOVATION & TECHNOLOGY

Innovation

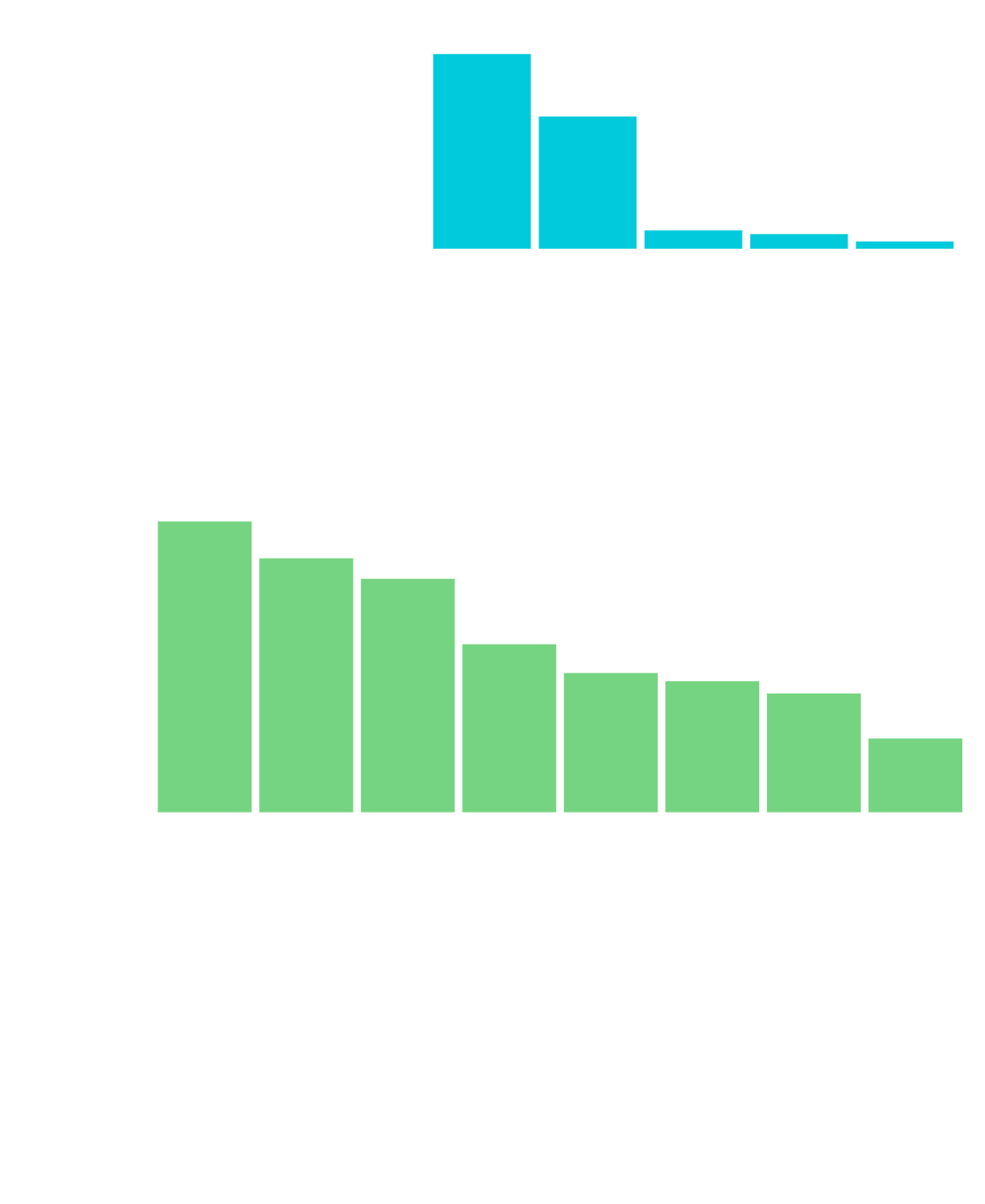

69% of organizations globally cite innovation as a priority for legal and regulatory risk management. The majority is most emphatic in the private held companies. Here, 70% prioritize innovation compared to around two-thirds of public companies.

Among private companies there are also significant regional differences. Almost three-quarters of companies across Europe (74%), Asia-Pacific (73%) and Middle East & Africa (71%) give innovation as priority. In North America the figure drops to 61%.

Artificial intelligence & Generative AI are clearly viewed as the primary areas of focus by an overall 44% of companies globally. This is effectively double the next most-rated innovation area, Contract Management. Digitalisation (becoming paperless) is the third most prevalent subject, prioritized by broadly 1-in-8 companies across sectors and regions. In North America, 11% of respondents also mention document and process management.

68%

of global legal departments cite investment in technology

as a priority

Technology

Investment in technology is highly prominent in legal spending plans, with 68% of organizations citing investment in technology as a priority and 62% of organizations expecting an increase in investment in technology, against just 6% that expect to reduce their investment. Privately owned companies in particular are focused on this area. Almost three-quarters (73%) say that investment in legal department technology is a priority.

There is also a marked difference between the level of priority given in the Latin America, Middle East & Africa and Asia-Pacific regions (80%, 76% and 73% respectively), compared to Europe (67%) and North America (61%).

Regional Differences Among Companies when Prioritising Legal Department Innovation

Most investment growth is expected to be in four technology areas, broadly consistent across geographies and between public and private companies. Data privacy & security management is generally the highest priority, along with document management, contract lifecycle management and contract automation. The vast majority of legal departments (over 80%) will continue investing in these areas – and most investment growth is focused within these areas.

69%

of global legal departments cite innovation as a priority for legal and regulatory risk management

Workflow management, e-signatures, and Legal research/precedent databases can also expect to see more growth than decline in technology investment. Investment levels among private companies will be notably higher than in public companies, by roughly 10 percentage points.

Latin America and the Middle East & Africa region expects the highest levels of legal department technology investment growth. The main priorities are legal research/precedent databases, and data privacy & security management. Workflow management, document management and contract automation technologies also feature prominently.

Asia-Pacific will also focus on specific technologies such as workflow management and e-signatures, in addition to the four main areas. Investment by North American and European companies also appears to be more distributed across various technologies.

Number of Organizations Expecting to Invest More in These Technologies

49%

42%

Data privacy & security management

Contract lifecycle management

44%

34%

74%

73%

Europe

Asia-Pacific

71%

61%

Middle East

North America

Document management

Workflow management

Cost is by far the biggest barrier to adoption of legal department technology, cited by 79% of companies globally. This is followed by lack of integration with other technologies within the organization (54%) and implementation risk (41%). Data privacy concerns are considered a much lesser barrier in Europe and North America (25-28%) than in Asia Pacific and Middle East & Africa (47-57%).

Sponsored by

PRIORITIES & CHALLENGES

Priorities

Supporting business growth is the main priority for global in-house counsel in the coming year. About a third of respondents (31%) see it that way, with Risk Management coming as a somewhat lesser, second priority at 18%. The figures are most pronounced in public companies. 34% rank support for business growth as top priority, against 31% of private companies. For risk management it’s 21% public vs 15% private companies.

Supporting business growth is the main priority for global in-house counsel

Personal learning & development features strongly as the third greatest priority at 17%. But the overall figure disguises a marked difference of opinion at different job levels within the organization. Personal learning & development is by far the most common top priority among Senior Counsel (35%) and Counsel (37%) but mentioned by only 6% of GC/CLOs. Legal department leaders should, therefore, ensure that the right learning and development programs are in place to support their teams’ development and to ensure higher staff retention rates.

For GC/CLOs and Legal Directors/Managers the most common top priority, at 36% and 32% respectively, is supporting business growth.

Risk management is the second most commonly cited priority across all four role areas.

The most common top priorities do vary between regions. An emphatic 47% of North American respondents rank supporting business growth over their second most common top priorities, Data privacy compliance and Personal learning & development (10% each). Respondents in Latin America also most often rank supporting business growth as their top priority. Interestingly, across the rest of the world, supporting business growth is only the second most common top priority. Europe (31%) and Middle East & Africa (28%) rank risk management as the most common top priority. In Asia-Pacific, 30% place Personal Learning & Development first.

My Top Business Priority in the Coming Year is:

1

Supporting business growth

2

Risk management & compliance

3

Personal learning & development

Globally, support and wellbeing of staff is a somewhat prominent priority, especially among public companies. At 13% it’s just outside the top three most common priorities, nearly twice the proportion for private companies (7%). This appears to be driven by the concerns of more senior staff, being the third most-mentioned priority for GC/CLOs at 13% – a figure mirrored among Legal Managers and Directors of Legal Services at 12%. However, given what our survey has to say about expected challenges in the year ahead, with very high levels of work-related stress and anxiety prevalent across all global in-house counsel job levels, perhaps more legal department leaders should have staff wellbeing and support as a top priority.

32%

36%

Legal Directors/ managers prioritise supporting business growth

GC/CLOs prioritise supporting business growth

Challenges

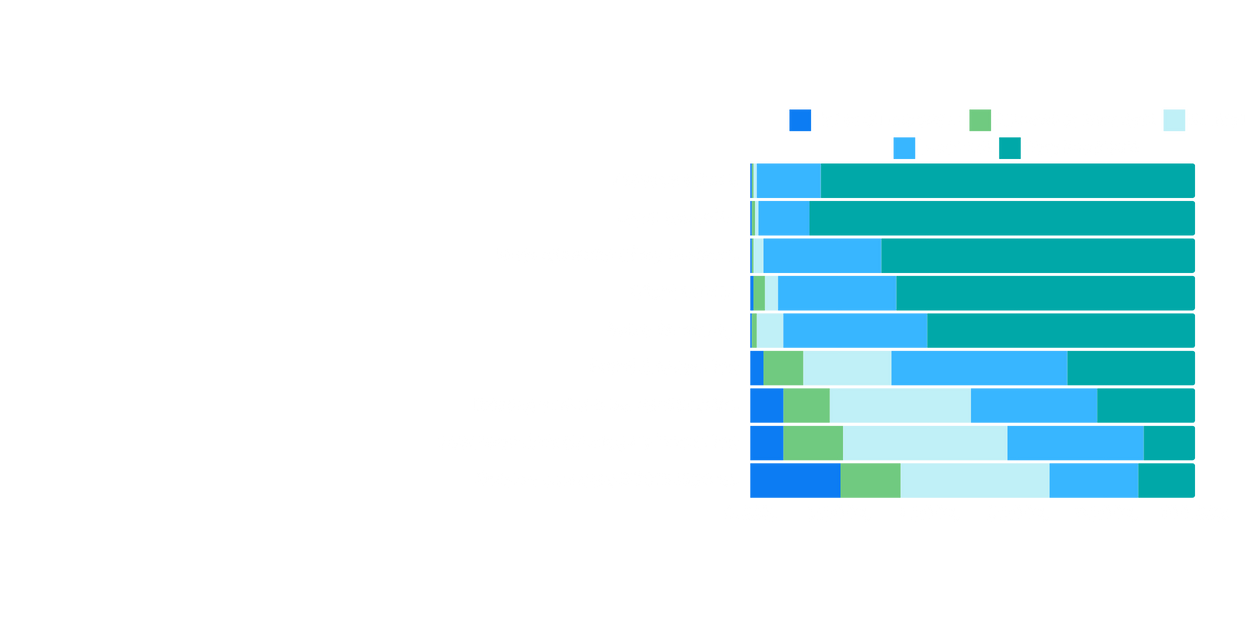

54% of all respondents reported an increase in their work-related anxiety and stress levels in the last year. This increase is evident right across the globe, with over 50% of respondents reporting increases in all regions except Asia-Pacific which – at 44% – is still significantly high.

The increase is highest in private companies (55% of respondents) but still over half (52%) in public companies. This seems to impact senior levels most, with 57% of GCs/CLOs experiencing increased work-related anxiety and stress levels in the past year – the highest percentage of all job roles.

While the figures for increased anxiety and stress are high, it’s also significant that just 11% of respondents reported a decrease – 8% for GC/CLOs. This raises the prospect of a potential employee wellbeing and mental health crisis looming in the coming year.

The survey suggests workload / volume of work is the main driver of rising stress levels. In fact it's the standout top challenge across all four role areas, with 29% of global in-house counsel citing workload as the biggest challenge for them. The figures are also broadly consistent across role areas, ranging from

25-30%.

'Workload' is the most-cited single greatest challenge across all in-house job levels

Other than workload, regulatory change (13%) and risk management (12%) rank as the second and third highest challenges companies expect to face.

But there are regional differences. Workload is clearly identified as the single biggest challenge by a substantial margin in North America (32%), Asia-Pacific (27%) and Middle East & Africa (47%). But Europe bucks the trend, with 18% ranking regulatory change as the greatest challenge – relatively more than workload at 16%.

There are regional differences in the second and third ranked challenges. In Asia-Pacific, 10% of companies place each of data privacy compliance and cybersecurity as their next highest-ranked challenges. In North America it’s regulatory change (14%) then litigation (13%). In Middle East & Africa, 19% put risk management as the second most-ranked top priority, well ahead of any other topics.

Private companies are looking at a broader spread of challenges than public companies, with 12% putting cybersecurity on a par with regulatory change – and 11% mentioning litigation.

High levels of work-related stress and anxiety prevalent across all global

in-house counsel job levels

Beyond the broad consensus over workload being the greatest challenge, staff see the challenges differently. GC/CLOs put risk management, regulatory change and cybersecurity on an equal footing – with 13% selecting each of those three topics. For Senior Counsel it’s more about risk management (18%) and data privacy compliance (13%). Counsel also rank risk management (18%) as their second highest challenge. 15% of Legal Directors and Managers put risk management in second place, alongside litigation.

Sponsored by

PEOPLE & TALENT

Skills and Responsibilities

Our survey garnered responses across all job levels to deliver a view from the top, as well as from middle and junior in-house legal roles across all regions. The headline finding is that a vast majority of in-house counsel have significant accountabilities beyond their legal responsibilities.

A remarkable 74% of in-house counsel carry responsibility for compliance. The figure is fairly consistent across all role levels. This suggests compliance is now widely integrated into the legal function. Responsibility for compliance is highest by far in Middle East & Africa (84%) and Asia-Pacific (83%), outstripping other non-legal accountabilities. But the spectrum of non-legal accountabilities is broader still. 41% are responsible for Ethics, 38% for company secretarial duties. Moreover, a third (33%) carry responsibility for investigations – and over a quarter (26%) for government relations.

The burden falls mainly on GC/CLOs, more so than any other role. These additional responsibilities are dominated by compliance (79%), company secretarial (58%), ethics (56%) and investigations (43%).

Changes in Reported Levels of Work-Related Stress and Anxiety Compared to Previous Year

54%

35%

Increased

Stayed the same

11%

Decreased

Almost one in five (18%) of all in-house counsel now also shoulder some Environmental, Social & Government (ESG) responsibilities. This is most pronounced in the North American and European regions.

These figures seem to reinforce the concerns expressed about workload and the attendant increase in work-related stress levels. But more positively, this broadening of remit may also indicate a wider reach and influence for in-house counsel within the organization.

This idea is perhaps borne out by looking at the key skills needed to be an effective global in-house lawyer. The common responses across all company types and regions are: understanding the business, legal knowledge, flexibility / adaptability, and giving practical advice. Understanding the Business stands out as the primary requirement. But there are regional variations to what are considered the other most important skills. North American companies rate communication skills more highly. But in Europe,Asia-Pacific and Latin America, flexibility and adaptability are more key. Legal knowledge ranks highest in Middle East & Africa.

Greatest In-House Counsel Challenges

29%

Workload/

volume of work

13%

Regulatory change

12%

Risk management

Hybrid Working

Two years on from the Covid-19 pandemic, the survey looked into the prevalence and challenges of hybrid working. Such arrangements are available to a large majority (71%) of global-in house counsel. While 21% are back in the office full-time, 8% are working

full-time from home or remotely.

Remote/Hybrid Working Arrangements

Hybrid location model

71%

Fully in-office

21%

Fully work from home/remote

8%

Big Regional Differences in Support of Hybrid Working

81%

Europe

74%

32%

65%-67%

LATAM &

Asia-Pacific

North

America

MEA

Hybrid is most prevalent in public companies, where over three-quarters (76%) have a hybrid model in place. This contrasts with 68% of private companies. The figures for fully in-office working are very similar, with around 20% across both public and private companies. But arrangements for fully remote or at-home working are more than twice as likely in a private company (11%) than a public company (5%). 2 or 3 office days a week is most prevalent where there is a mandated number of office days. With 43% of organizations adopting this model, it seems to be an arrangement that is here to stay. For comparison, 24% of organizations mandate 5 days a week as office days, while 17% don’t apply a mandated arrangement.

The data is broadly similar across public and private companies. But public companies mandate 4 office days more than twice as often (15%) as private companies (7%). Data about the challenges of hybrid working is broadly similar across Public and Private Companies.

From a regional perspective, hybrid working arrangements are most prevalent in Europe (81% of organizations, North America 74%, followed by Latin America and Asia Pacific (65%-67%). Just 32% of organizations in the Middle East & Africa support hybrid, with 68% operating fully in office, much higher than all other regions – roughly one third of Asia Pacific and Latin American are fully in office and just 1-in-9 organizations in Europe and North America

There’s consensus that employee engagement is the primary concern coming out of hybrid working. 29% of respondents rank it as challenging or extremely challenging. Next up is the adoption of the new technologies needed to enable hybrid working, followed by the handling and production of sensitive data remotely.

In-House Personnel Accountability Beyond Legal

74%

responsible for compliance

41%

responsible for ethics

38%

responsible for company secretary duties

33%

responsible for investigations

26%

responsible for government relations

18%

responsible for

ESG

Sponsored by

ICW | Mondaq

Global In-House Counsel Report 2024

Unique Insights into the Global In-House Profession

Think before you print

Sponsored by